If you don’t, you could end up underpaying your taxes, and that can lead to avoidable IRS penalties. As with expenses, your accounting method will determine exactly when to record income. While recording by hand may be the cheapest solution, it can be time-consuming and prone to errors.

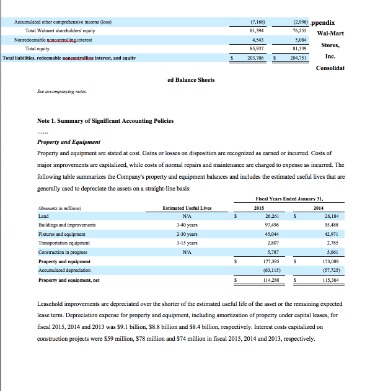

Balance Sheet

FreshBooks is one of the most highly rated and straightforward programs for accurate accounting records, professional bookkeeper services, and more. Income statements feature the business expenses and revenue by different categorized profit centers. A bookkeeping checklist outlines the tasks and responsibilities you need to do regularly to keep the books up-to-date and accurate. It serves as a road map to ensure you correctly record and report all necessary financial transactions are recorded and reported correctly. To set up a budget, gather your financial data, such as income statements, balance sheets, and cash flow statements.

Keep Tabs on Labor Costs

It’s also helpful to understand how to market your services and manage the financial side of running a business. It can take a professional bookkeeper 2 to 4 hours to process one month’s worth of bank transactions, finalize a bank reconciliation, and produce a set of reports. … And they will have to be processed if they are mixed up with the business transactions. They have to be entered into the bookkeeping system and coded to drawings, taking up precious time that the bookkeeper could just spend entering business data. Processing transactions for your personal expenses within the bookkeeping of your business is a waste of precious time.

Importance of accounting and bookkeeping for small businesses

- Before you choose your business name, make sure someone else isn’t already using it, lest clients get confused.

- It’s ultimately your responsibility to understand which applies to you, and how and when to submit your tax return to HMRC.

- But what might seem like an overwhelming task isn’t so bad when you break it down to the bookkeeping basics.

- However, you may reach a point where no enthusiasm or persistence level can help.

Accountants offer expert knowledge, help optimize your tax strategy, and ensure your bookkeeping aligns with best practices. We recommend consulting with a professional to make sure your books are headed in the right direction. If tax season is still a source of stress, check out these tax tips for small businesses.

However, when you see certain items such as a bank fee that you may not have recorded in your books, you will need to reconcile your records. When you start a new business, you need to set up a chart of accounts to journal transactions in any of the five categories including assets, liabilities, expenses, revenue and equity. This chart of accounts is used to gather statements, analyze progress, and locate transactions. Keep a separate bank account for your personal and your business expenses. If you’re a solopreneur or independent contractor, chances are you’re responsible for everything, including the accounting.

Learn When It’s Time to Outsource

On top of that, you need the data used in bookkeeping to file your taxes accurately. As a business owner, it is important to understand your company’s financial health. Bookkeeping puts all the information in so that you can extract the necessary information to make decisions about hiring, marketing and growth. Though often confused for each other, there are key differences between bookkeeping and accounting. At its core, bookkeeping is about recording financial data, while accounting is about interpreting financial data. At the same time, businesses need to make sure they pay their own bills on time to avoid late fees and maintain a solid reputation.

Making sure your records are well-organized can save you a big headache if you’re ever subjected to an audit. You’re also responsible for communicating with your employees and allowing them to know the financial state of your firm. They need to know if the company is making some progress and how they contribute to its growth. Bookkeeping accounting ensures that you have the right information to talk to your team and make them feel like they’re part of the company. Jami Gong is a Chartered Professional Account and Financial System Consultant.

You can withdraw a regular salary from the business or, if you’re a sole proprietor, pay yourself using the draw method. These withdrawals, also known as an owner’s draw, are easy to track and document in your bookkeeping. Whether you pay yourself officially by draw or salary, those transfers should be recorded in your business account statements.

Bookkeepers record and classify financial transactions, such as sales and expenses. They maintain accurate records of daily financial activities and manage accounts payable and accounts receivable. Bookkeeping is the process of tracking income and expenses in your business.

This might be tricky at first, but practice makes progress, and soon you’ll start to see some improvements. At Business.org, our research is meant to offer general product and service recommendations. We don’t guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products how job costing works in cost accounting and services. After all, if you don’t know how much you’re making or where that money is going, you’ll have a hard time finding ways to expand your profitability. We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers.

When you’re updating your numbers every week, you can pull reliable financial documents at any time. Straightforward accounting software allows you to view your income statement and balance sheet at the click of a button. Separating your accounts doesn’t mean that your business doesn’t pay you, of course.

It’s never too early to take ownership of your bookkeeping policies. By following the tips and best practices outlined in this guide, you’ll be more equipped to set a strong financial foundation for future growth, profitability, and ultimate success. Every transaction you make needs to be categorized when it’s entered in your books. This helps your bookkeeper catch more deductions, and will make your life easier if you get audited. Paying bills and invoicing happen daily, so they can be complicated to outsource. But complex projects like reconciling your accounts and closing the books should be done by a professional.

It can help determine if your business is taking on too much debt to support its revenue. If you find it feasible to keep your books in-house, https://www.simple-accounting.org/cash-basis-accounting-explain-examples-contrast/ you might consider using a software accounting program. This can help alleviate some problems you might run into with manual record keeping.

However, if you don’t have a lot of bookkeeping experience (or don’t have time to learn), they could stress you out more than they help you. Especially if your accountant ends up telling you you’ve been using them incorrectly for the past year. If you need to borrow money from someone other than friends and family, https://www.online-accounting.net/ you’ll need to have your books together. Doing so lets you produce financial statements, which are often a prerequisite for getting a business loan, a line of credit from a bank, or seed investment. Luckily, with simple bookkeeping tips in this article, you can streamline the whole process in a matter of days.